Explore the best rental yields in the world for 2025. Invest wisely in top countries like the UK and the USA. Maximise returns today!

Did you know that the real estate rental market grew from $2,601.92 billion in 2023 to an estimated $2,806.83 billion in 2024, reflecting a compound annual growth rate (CAGR) of 7.9%? This surge is driven by many factors, such as improving economic conditions, shifting consumer preferences, evolving interest rates, and global events.

The best part is that it is projected to reach $3,749.95 billion by 2028, maintaining a steady CAGR of 7.5%. Also, the rise in sustainability trends, the impact of remote work, affordability concerns, supportive government policies, and ongoing global challenges are some of the reasons behind this growth.

Hence, for property investors who want to invest in global markets with high rental yields, it is the best time to maximise returns and diversify their portfolios. In this guide, you will find top countries offering the best rental yields, supported by data and actionable insights to help you make informed investment decisions.

Before exploring the top countries offering the best rental yields, let's first understand what the term means.

What is Rental Yield?

Rental yield is the annual rental income expressed as a percentage of the property’s purchase price. It’s a crucial metric for property investors as it indicates the potential return on investment (ROI). High rental yields often signify a profitable market, but other factors, such as property appreciation and economic conditions, should be considered.

To maximise profits, it's important to calculate both gross and net rental yield accurately.

Calculating Gross and Net Rental Yields

Gross Rental Yield: This is calculated by dividing the annual rental income by the property’s purchase price, excluding expenses. While easy to compute, gross yield doesn’t account for ongoing costs like maintenance, property taxes, and insurance.

Formula:

Gross Yield= (Annual Rental Income ÷ Property Purchase Price) * 100

Net Rental Yield: Net rental yield provides a more precise measure of profitability by factoring in all property-related expenses, such as maintenance, taxes, and management fees.

Formula:

Net Yield= { (Annual Rental Income-Annual Expenses) ÷Property Purchased Price} * 100

As a smart investor, focus on markets with high net rental yields, steady demand, and low vacancy rates to ensure consistent and sustainable returns.

Why Global Markets Matter

Investing in global property markets offers the opportunity to diversify your portfolio and take advantage of favourable economic conditions and regulations. Several key factors play a role in shaping rental yields around the world, including:

Economic Stability: Stable economies often offer reliable rental demand.

Tourism and Expats: Popular tourist destinations and expat hubs see higher rental demand.

Property Prices: Affordable properties with high rental demand yield better returns.

Regulations and Taxes: Favourable policies attract foreign investors.

After understanding rental yield and its global importance, let's explore the top global countries for investments and rental yields.

Top 10 Countries for Property Investment and Rental Yields

United Kingdom: A Stable Economy and Thriving Property Market

The United Kingdom is a magnet for real estate investors, offering stability, consistent growth, and a well-established market. With a reliable economy and strong rental yields, it continues to attract investors from around the world, particularly those seeking refuge from less stable markets.

GDP: $3.588 trillion (2024)

Population: 69.14 million

Average Rental Yields: 7.4% (North) and 5.2% (South)

Why the UK Stands Out:

Consistent Growth: Over the past 30 years, the UK property market has consistently outperformed other investments.

Growing Demand: A rising population and limited housing supply are driving prices up.

High Rental Demand: Renting is becoming more popular due to lifestyle changes and affordability concerns.

Rental Yield Insights:

The UK property market offers diverse opportunities for investors, with rental yields varying significantly across regions.

London: The Crown Jewel of the UK Market

London’s global appeal, economic strength, and dynamic rental market make it a magnet for real estate investors. Property prices in the capital are high, and rental yields in select areas, especially in up-and-coming neighbourhoods and luxury developments, can exceed as much as 5%.

The North: High-Yield Powerhouse

Northern cities like Manchester, Liverpool, and Sheffield offer rental yields averaging 7.4%, driven by economic expansion and increasing demand for housing. These areas benefit from large-scale regeneration projects, growing student populations, and thriving industries, making them attractive for investors seeking robust returns.

The South: Prestige with Moderate Returns

In the South, rental yields average 5.2%, reflecting higher property prices and competition. Despite this, cities like Bristol and Southampton continue to attract investors with their economic growth and quality of life, offering stable returns.

Pro Tip for Investors: Investing in rental properties can be a smart choice for those seeking steady returns and reduced risks. Areas like Middlesbrough and Durham are emerging as prime locations for such opportunities. With the UK's ever-evolving property market, diversifying your portfolio into these sectors not only stabilises returns but also ensures consistent growth.

United States: A Vast Market Backed by Strong Fundamentals

The United States offers a vibrant and diverse real estate market underpinned by its stable economy and the US dollar’s status as the world’s reserve currency. Major cities like New York, Los Angeles, and Chicago deliver strong rental yields, driven by consistent demand from professionals, students, and expatriates.

Financing options for international investors, including mortgage loans tailored for non-residents, make entry into this lucrative market more accessible. From luxury apartments in bustling urban centres to affordable homes in growing suburbs, the U.S. provides abundant opportunities that cater to various investment strategies and budgets, ensuring long-term financial growth.

GDP: $29.167 trillion

Population: 345.4 million

Average Rental Yields: 6.10%

Why the US Stands Out:

While major cities in the U.S. can be expensive, savvy investors can find plenty of opportunities with the right approach and research:

Emerging Markets: Target areas with significant growth potential to benefit from lower initial costs and higher appreciation rates over time.

Revitalising Neighborhoods: Look for neighbourhoods undergoing revitalisation, where new developments and infrastructure improvements can lead to significant value increases.

Fixer-Uppers: Purchase properties in need of renovation, where a little investment can lead to substantial returns as the property’s value increases with improvements.

Tip for Success: Stay updated on market trends and focus on long-term growth. A well-informed approach can unlock the vast potential of the US property market.

Germany: Europe’s Powerhouse with Promising Opportunities

Germany, with its stable political system and position as the largest economy in Europe, is an excellent choice for real estate investors. The country’s robust economy and expanding urban centres offer attractive opportunities for long-term growth.

Cities like Berlin, Munich, and Frankfurt stand out for their appealing rental yields, providing consistent income for property owners. Renowned for its affordability and reliability, Germany continues to be a top pick for international buyers seeking stability, financial security, and promising returns.

GDP: $4,710.03 billion

Population: 84.55 million

Average Rental Yields: 3.67%

Why Germany Stands 0ut:

Lower Property Prices: Compared to other European countries, Germany offers accessible entry points.

Tax Incentives: Investors can enjoy tax breaks for depreciation and renovations.

Strong Rental Demand: Thriving cities and a growing population ensure steady rental income.

Government Support: subsidies and low-interest loans for energy-efficient upgrades enhance profitability.

Germany’s stability, coupled with these advantages, positions it as a secure and lucrative market for property investors.

Japan: Opportunities in a Stable Economy

Japan's dynamic urban centres, led by Tokyo, offer outstanding prospects for real estate investors. Known for its strategic location in East Asia, Japan benefits from a stable economy, a robust infrastructure, and a strong demand for rental properties. Cities like Osaka and Kyoto complement Tokyo's appeal, offering affordability, tourism-driven demand, and growing expatriate communities.

This combination of economic stability, cultural allure, and investment potential cements Japan as a preferred destination for global property investors.

GDP: $4.07 trillion

Population: 123.75 million

Average Rental Yields: 4.33%

Why Japan Stands Out:

Tokyo: As a global financial hub and one of the most populous cities in the world, Tokyo boasts a thriving economy and high rental yields. Its advanced infrastructure, strong job market, and continuous influx of both domestic and international migrants ensure consistent demand for housing. Tokyo’s real estate market also benefits from its reputation for stability and resilience, making it a top choice for investors seeking steady returns.

Osaka and Kyoto: These cities combine affordability with unique investment potential. Osaka, known for its vibrant economy and cultural significance, offers attractive property prices and a growing expat community, driving rental demand. Kyoto, famous for its historical landmarks and flourishing tourism industry, provides a steady stream of short-term rental opportunities.

Both cities are supported by strong local economies and increasing interest from international buyers, making them prime investment destinations.

Investors in Japan benefit from a combination of high demand, cultural appeal, and promising returns, particularly in urban and tourist-friendly areas. Additionally, Japan’s efficient legal framework and transparency in property transactions make it an investor-friendly market.

Malaysia: Affordable and Growing

Malaysia stands out in Southeast Asia due to its affordability and strong growth potential. The government’s active promotion of foreign investment makes it an attractive destination for property investors.

GDP: $439.75 billion

Population: 35.56 million

Average Rental Yields: 5.24%

Why Malaysia Stands Out:

Affordable Prices: Malaysian properties are attractively priced compared to other Southeast Asian countries, making them accessible to investors. The combination of competitive pricing and high-quality developments ensures value for money and promising appreciation potential.

Tourism Growth: Malaysia’s growing appeal as a global travel destination, with its vibrant cities and natural attractions, fuels demand for hospitality and residential properties. This trend creates opportunities for short-term rentals and long-term capital gains.

Infrastructure Development: Ongoing government investments in transportation and tourism infrastructure, such as new highways, rail networks, and airports, enhance connectivity and elevate property values in key regions.

With competitive pricing and government incentives, Malaysia is a promising market for both new and experienced investors.

UAE: High Yields in a Tax-Free Haven

The UAE, with its iconic skyline and dynamic urban landscape, offers more than just stunning visual appeal. Its tax-free environment and highly lucrative rental market make it ideal for property investment. These advantages, coupled with a growing economy and a business-friendly atmosphere, make the UAE an exceptional destination for both local and international investors looking to capitalise on its potential.

GDP: $568.52 billion

Population: 11.027 million

Average Rental Yields: 4.87%

Benefits of Investing in the UAE:

No Property Taxes: Save on taxes, except for a minimal 4% transfer tax.

High Rental Yields: Dubai Marina and Jumeirah Lake Towers offer yields up to 9.7%.

Diverse Options: From luxury apartments to commercial spaces, there’s a wealth of investment opportunities.

With its modern infrastructure and investor-friendly policies, the UAE remains a top choice for global investors seeking high returns.

New Zealand: Scenic Beauty Meets Market Strength

New Zealand’s breathtaking landscapes and strong property market performance make it a prime destination for real estate investors. The country's stable economy, low unemployment rate, and high demand for housing in major cities further enhance its appeal.

GDP: $262.92 billion

Population: 5.214 million

Average Rental Yields: 4.21%

Why Invest in New Zealand:

Strong Economy: New Zealand boasts a resilient and diversified economy supported by thriving sectors like agriculture, tourism, and technology. Its economic stability attracts global investors seeking reliable long-term returns.

Low Unemployment Rate: With one of the lowest unemployment rates globally, the nation’s workforce contributes to sustained economic growth, creating a stable environment for property investments.

High Demand for Housing: Major cities like Auckland, Wellington, and Christchurch are experiencing significant population growth, fueling the demand for residential properties. This urban expansion ensures steady appreciation in property values and consistent rental income.

Variety of Property Types: New Zealand offers diverse real estate options, from modern apartments in bustling cities to expansive countryside homes. Investors can tailor their portfolios to meet various financial goals and market demands.

High Quality of Life: Ranked among the world’s best countries for quality of life, New Zealand attracts both residents and expatriates. Factors like excellent healthcare, education, and low crime rates make it a desirable place to live, increasing long-term housing demand.

Investment Highlights:

Consistent Growth: The property market has steadily appreciated over the years, offering attractive returns for both local and foreign investors.

Tourism Appeal: As a top tourist destination, New Zealand enjoys a high demand for short-term rentals, especially in scenic areas.

Investing in New Zealand offers financial stability and the opportunity to own property in one of the world's most beautiful and livable locations. This combination of natural appeal and economic strength makes it an outstanding choice for savvy investors.

India: A Rising Star in Real Estate Investment

India's real estate market is experiencing unprecedented growth, driven by rapid urbanisation, infrastructure development, and a young workforce. The country’s diverse economy and government initiatives make it an attractive destination for domestic and international investors. Some of its key highlights are mentioned below:

GDP: $3.89 trillion

Population: 1,451 million

Average Rental Yields: 4.98%

Key Benefits of Investing in India:

High Growth Potential: Cities like Bengaluru, Hyderabad, and Pune are emerging as IT and business hubs, driving demand for both residential and commercial properties.

Affordable Entry Points: Compared to other global markets, Indian real estate offers competitive property prices with substantial appreciation potential.

Government Initiatives: Programs like ‘Housing for All,’ RERA regulations, and tax benefits for home loans create a favourable environment for property investments.

Infrastructure Development: Projects such as smart cities, metro networks, and expressways are boosting real estate opportunities nationwide.

Emerging Markets in India:

Bengaluru is known as India’s Silicon Valley. Due to the influx of IT professionals, there is a high demand for rental properties.

Hyderabad: Affordable property prices and rapid infrastructure growth make it a top choice for investors.

Mumbai Metropolitan Region (MMR): Despite being pricier, it guarantees long-term appreciation and steady rental income.

Tier II Cities, such as Ahmedabad, Kochi, and Indore, are gaining traction due to their affordability and growing job markets.

Pro Tip for Investors: Focus on under-construction properties for early bird pricing or co-living spaces in metros, catering to the millennial and Gen Z workforce.

Cyprus: A Mediterranean Haven for Real Estate Investment

Cyprus combines favourable taxation policies, a high quality of life, and solid rental yields, making it a compelling destination for real estate investors. Its strategic location at the crossroads of Europe, Asia, and Africa adds to its appeal, providing excellent connectivity and a thriving expatriate community.

GDP: $34.79 billion

Population: 1.3583 million

Average Rental Yields: 4.57%

Why Cyprus Stands Out:

Tax Benefits: Investors enjoy a 0% tax rate on income up to $23,399 and straightforward taxation policies beyond that threshold.

Residency and Citizenship Opportunities: Property investment can lead to permanent residency and, after five years, eligibility for Cypriot citizenship, granting visa-free access to over 170 countries.

Tourism-Driven Demand: With its pristine beaches, rich history, and favourable climate, Cyprus attracts millions of tourists annually, creating steady demand for short-term rentals.

Rental Yield Insights:

Limassol: Known for its cosmopolitan vibe and robust business activity, Limassol offers high-end properties with strong rental returns.

Paphos: A hub for retirees and tourists, Paphos delivers consistent rental income, especially for holiday homes.

Pro Tip for Investors: Focus on areas with increasing tourist footfall or developing infrastructure projects to maximise returns.

France: A Stable Market with Timeless Appeal

France's thriving tourism industry, diverse landscapes, and stable economy make it a favourite among real estate investors. The country offers a mix of short-term vacation rentals in tourist hotspots and long-term rental opportunities in bustling urban centres.

GDP: $3,130.01 billion

Population: 66.55 million

Rental Yield: 4.7%

Why France Stands Out:

Tourism-Driven Demand: France welcomed 218 million tourists globally in 2019, creating robust demand for short-term rentals, especially in cities like Paris and Nice.

Diverse Landscapes: From the romantic allure of Paris to the serene countryside and vibrant French Riviera, the variety ensures opportunities for every investor type.

Investment Security: As the world’s seventh-largest economy, France provides a low-risk environment for foreign investors, supported by accessible property laws.

Rental Yield Insights:

Paris: Known for its iconic landmarks and cultural significance, Paris offers excellent long-term rental opportunities for students, professionals, and expatriates.

Nice: Located on the French Riviera, Nice is a hotspot for luxury vacation rentals and attracts high-net-worth tourists.

By exploring these diverse markets, you can find opportunities tailored to your investment goals. But here, you might also have a question about how to choose the best real estate markets of your choice. So, keep reading.

How to Choose the Right Market for Property Investment

Choosing the right market for property investment requires a strategic approach and thorough research to maximise returns and mitigate risks. Here are key factors to consider:

Understand Local Laws

Understanding local laws is very important before investing in property, as property ownership and rental regulations vary significantly across countries. Some markets restrict foreign ownership, while others offer incentives like residency permits for investors. Local law also helps in understanding rental rights and legal requirements for purchasing and selling property. For instance, countries like the UAE provide tax-free rental income but have specific regulations for foreign investors.

Analyse Costs

Property investment involves more than the purchase price. It also requires calculating ongoing expenses such as property taxes, insurance, maintenance, and management fees. Be aware of transaction costs like legal fees, stamp duties, and currency exchange rates. Understanding the tax structure, including rental income and capital gains taxes, is essential for accurate profitability assessments before investing in property.

Research the Market

To evaluate the real estate market's stability, study trends in rental demand, property appreciation rates, and vacancy levels. Look for economic drivers such as tourism, urbanisation, population growth, and infrastructure development. Markets with a growing middle-class or expat community often provide higher rental yields.

Consult Experts

Partnering with local real estate agents, financial advisors, or legal consultants can help you navigate the complexities of foreign markets. Experts provide valuable insights into neighbourhood trends, rental laws, and profitable investment opportunities, ensuring an informed decision.

By focusing on these elements, investors can identify markets that align with their goals while minimising risks. The global property investment landscape is also evolving, with new structures and trends reshaping how investors approach real estate.

From modern financing methods to tech-driven solutions, investors are leveraging innovation to access diverse markets, optimise portfolios, and enhance decision-making. Let’s examine them.

Innovative Investment Structures and Emerging Trends

As said, this section highlights key strategies and emerging opportunities transforming global property investments today.

Real Estate Investment Trusts (REITs)

REITs simplify property investment, offering liquidity, diversification, and professional management. They allow access to high-value properties with minimal capital. Many nations, like Japan with J-REITs, have embraced REITs, unlocking global real estate markets. For investors, REITs eliminate management hassles and provide exposure to lucrative property sectors.

Crowdfunding and Fractional Ownership

Crowdfunding platforms enable multiple investors to pool resources for property investments, offering diversification and expert-managed opportunities with lower capital. Similarly, fractional ownership lets investors buy shares in high-value properties. These models democratise access to prime real estate, simplifying management and broadening portfolio options.

Proptech and Data-Driven Investing

Proptech is revolutionising real estate with big data, AI, and blockchain. Investors benefit from virtual property tours, advanced market analysis, and transparent transactions. IoT devices enhance energy efficiency and building management, making international investments more informed and streamlined through technology.

Sustainable and Impact Investing

ESG (Environmental, Social, and Governance) factors are increasingly influencing property investment decisions. With a growing focus on sustainability, investors are prioritising energy-efficient buildings and wellness-oriented amenities that support the environment and add long-term value. Sustainable properties are seen as a way to attract premium rents and ensure future resilience.

Investors are also focusing on urban regeneration projects, affordable housing, and properties with green certifications, aligning their financial objectives with broader social and environmental benefits.

Co-living and Flexible Living Spaces

Co-living spaces, serviced apartments, and student housing are gaining popularity as lifestyle shifts and the rise of the sharing economy reshape the way people live. These types of developments are especially appealing to young professionals, digital nomads, and travellers looking for flexible, community-oriented living options.

For investors, these trends offer the potential for higher returns and access to innovative living concepts, particularly in urban areas where housing demand is high.

Build-to-Rent and Multifamily Investments

Build-to-rent properties are created with long-term rental income in mind, featuring modern amenities that cater to the needs of urban residents. Multifamily investments, such as apartment complexes, offer steady cash flow and the potential for value-added opportunities. These sectors are experiencing significant growth in regions like the UK and the US, fueled by increasing demand for rental properties and rising rental trends.

Cross-Border Financing and Currency Hedging

Innovative financing and hedging strategies are helping to reduce the risks associated with international investments. Cross-border lending platforms, currency-hedged funds, and structured products provide foreign investors with competitive options for navigating the global property market. These tools make it easier for investors to access international opportunities while minimising challenges related to exchange rates and financing.

By embracing these innovations, investors can more effectively access global real estate markets. Staying adaptable and informed, from implementing proptech to exploring sustainable opportunities, is the key to long-term portfolio growth and success.

Conclusion

Property investment offers a lucrative way to generate income and build long-term wealth. The most attractive rental yields are typically found in markets that strike the perfect balance between affordability, strong demand, and investor-friendly regulations.

Whether you're a seasoned investor or just starting, choosing the right market is crucial for maximising returns. By understanding these key factors, you can make informed decisions and unlock the full potential of your property investments.

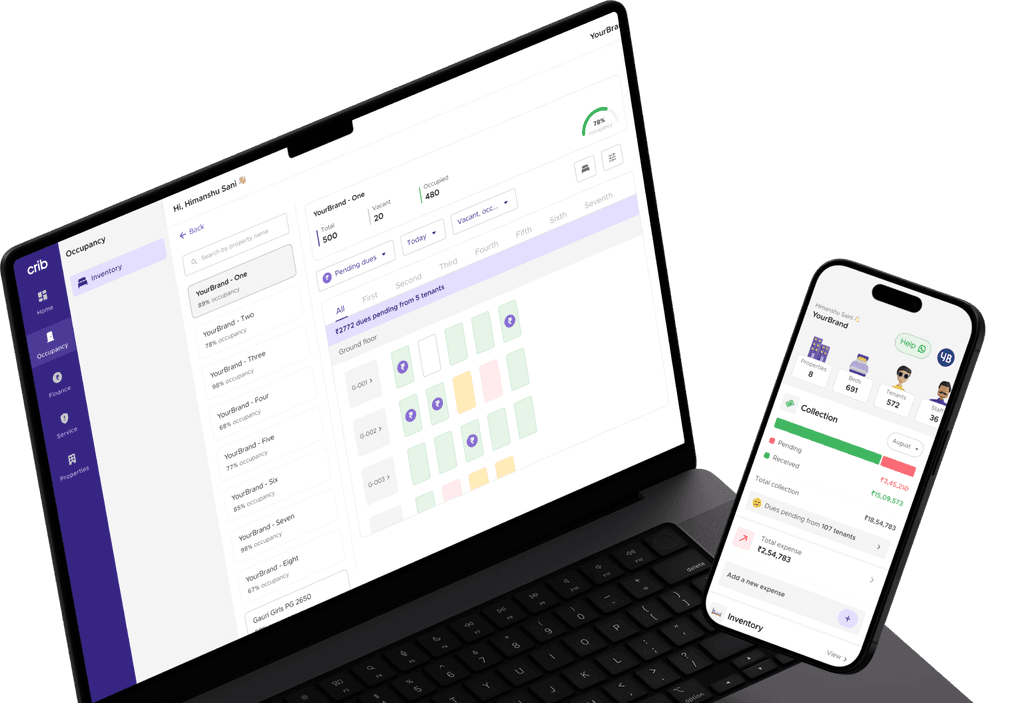

So, once you've secured your investment, efficient property management is essential to ensuring its continued success. Choose Crib as your all-in-one property management solution that simplifies your property management, rental operations, and tenant management. It is a white-label property app that offers features like:

Multi-property management: Easily manage multiple rental properties from one platform.

Tenant management: Streamline communication, rent collection, and tenant information.

Real-time tracking: Track your property operations in real-time for better control and efficiency.

Expense tracking: Track income expenses and generate financial reports.

Property listing: Create and manage property listings for prospective tenants.